The COVID-19 pandemic is an unforgettable event in our lives. A lot has changed over the pandemic, from perception to technology; the way we live has become easier yet complicated. Technology advancement has changed not only our IT sectors but also the financial services industry.

In fact, technology is constantly evolving, and maintaining customer expectations simultaneously is a new challenge. However, implementing ITSM for BFSI can be a great strategy to meet these challenges.

Most individuals, businesses, and government officials rely on the Banking, Financial Services, and Insurance (BFSI) sector for smooth operations and living.

However, the BFSI sector is under immense pressure to meet growing customer expectations, manage vast volumes of data, and ensure operational resilience amid evolving technological advancements. Cybersecurity threats and complex service delivery mechanisms are major challenges that demand innovative solutions

IT Service Management (ITSM) can be one of the best approaches to improve customer experience in the BFSI sector. The primary role of ITSM in BFSI is to streamline all processes, reduce disruptions, manage data security, and ensure smoother operations. By improving service delivery, ITSM can guarantee a seamless, efficient, and customer-centric BFSI environment.

Let’s learn more about ITSM and its core principles. Further, we will discuss how implementing ITSM in BFSI can be beneficial in the long run.

Understanding ITSM and its Relevance to BFSI

IT service management (ITSM) is a set of practices that focuses on better management and delivery of IT services in an organization. From managing IT teams to ensuring an improved incident management system, this approach prioritizes the needs of customers. By implementing the ITSM framework, companies can reduce redundancies, streamline IT processes, and build customer trust.

Some of the core principles of ITSM are:

- ITIL adoption: Effective process management serves as the foundation for a solid ITSM strategy. It outlines specific guidelines for each stage of IT service delivery. The ITIL framework guides IT services from initial development to continuous improvement. It further promotes continuous improvement and ensures alignment with growing corporate goals.

- Promote self-service: Self-service not only allows end users to tackle common difficulties independently, but it also considerably decreases the workload of IT help desks. It helps customers to find and resolve issues on their own, resulting in lower IT support tickets and more efficiency.

- Knowledge-Centered Service: Knowledge-Centered Service (KCS) gathers key insights gained during ticket resolution. IT teams convert this knowledge into easily accessible articles, allowing IT support personnel and end users to fix issues on their own. Thus, improves the effectiveness of IT support teams by transforming troubleshooting into a continuous learning resource.

- Effective change management: Streamlining change management helps organizations predict and mitigate interruptions. Further, it aids in the planning, assessment, and execution of changes while minimizing service disruptions. Finally, a defined change process reduces risks and enhances communication.

- Resource and capacity allocation: IT teams are more efficient when their resources are optimized. By combining ITSM and Project Portfolio Management (PPM), IT administrators can make certain that workloads are balanced between projects and support requests.

Remember, most financial institutions and the banking sector use a SaaS model to meet business requirements and deliver quality service, making IT service management crucial for this sector.

Cybersecurity, Cost Saving, Cloud Computing, and customer satisfaction are some of the major challenges and priorities for the BFSI sector as per a 2021 report. By incorporating ITSM in BFSI, businesses can deliver seamless services to their customers while maintaining data security.

ITSM in BFSI can further be beneficial in the following ways:

- Operational Efficiency: Task automation will reduce the chances of human error resulting in improved efficiency.

- Improved Resource Management: Management of large data in the BFSI sector is a big challenge. ITSM framework implementation can help optimize your IT resources as well as reduce costs.

- Minimal Service Downtime: By automating the incident management system, team members can resolve incidents faster, thus minimizing service disruptions.

- Quick Solution: By identifying errors and addressing potential problems faster before they impact customers, BFSI can improve customer experience and build trust.

- Improved Compliance: ITSM supports compliance with regulatory standards by streamlining processes and ensuring accurate documentation.

Key Areas of Impact

In the Banking, Financial Services, and Insurance (BFSI) industry, various areas can be affected by the ITSM framework. One key area is service availability and uptime, where ITSM ensures that banking applications, online transactions, and insurance platforms run seamlessly with minimal downtime.

Another critical area is compliance and risk management, where ITSM ensures that IT operations align with stringent regulatory standards. This reduces financial and reputational risks caused by non-compliance or data breaches.

Asset and configuration management provides transparency into IT resources, optimizing hardware, software, and licensing costs while ensuring maximum performance. IT service continuity is another focus, ensuring disaster recovery plans are robust, and maintaining business continuity during unforeseen outages.

Let us have a look at few more key areas of impact:

Customer Service and Support

With new technologies taking over different sectors, customers relying on financial services also expect quick service delivery and better management systems.

They demand faster and more effective support systems for their problems. BFSI institutions incorporating ITSM solutions can achieve these goals using the following ways:

- Quick Response and Resolution: ITSM tools provide automated ticketing systems and service desk facilities for customers that identify and resolve customer queries faster. Further, automated workflows can reduce response delays to customers, resulting in a better experience.

- Enhanced Customer Satisfaction and Support: Leveraging ITSM tools, such as AI-powered chatbots, FAQs, and self-service portals allows BFSI institutions to provide solutions to customers and track complaint status faster.

Incident Management

In the BFSI industry, even a minor data leak or mismanagement of sensitive financial data and transactions can hamper a financial institution’s reputation.

Hence, incident management is critical in the BFSI sector as it can result in huge losses and break your customer’s trust. With ITSM software, you can improve your incident management system in the following ways:

- Reduce Service Disruption: ITSM tools have the ability to identify potential issues and address incidents in real time. By automating reporting tasks, ITSM can reduce downtime and service disruptions.

- Streamline Incident Reporting: By categorizing issues, assigning them to dedicated teams, implementing a proper alert system, and continuously tracking the resolution process, BSFI can better handle incidents and improve resolution timelines.

Problem Management

While incident management focuses on addressing immediate issues, problem management identifies and resolves the root causes of repeated problems.

By resolving their common issues, financial institutions can attain more stability. Technical problems, security issues, and performance slowdowns are common in financial services. ITSM problem management system can guarantee smooth operations and reliable IT infrastructure through the following ways:

- Identify the root cause of problems: A problem happening frequently is generally due to a common root problem in a specific section. ITSM frameworks analyze incident trends and identify the root cause of the problems, resulting in lower chances of future problems.

- Implementing Preventive Measures: System upgradation or incorporating monitoring tools can help identify and prevent these recurring problems from escalating.

Change Management

The BFSI sector constantly evolves, and IT systems and processes must undergo frequent changes, such as upgrades, migrations, or new technology implementations.

This will make things much easier for financial institutions to manage and control. Hence, the application of change management is essential as it will help:

- Minimize risk: ITSM ensures that changes are planned, tested, and implemented systematically to avoid disruptions. Change management frameworks assess risks and provide rollback plans for smooth transitions.

- Smooth Transition to New Systems: BFSI institutions can use ITSM to train employees and customers, reducing resistance and ensuring the adoption of new technologies or systems.

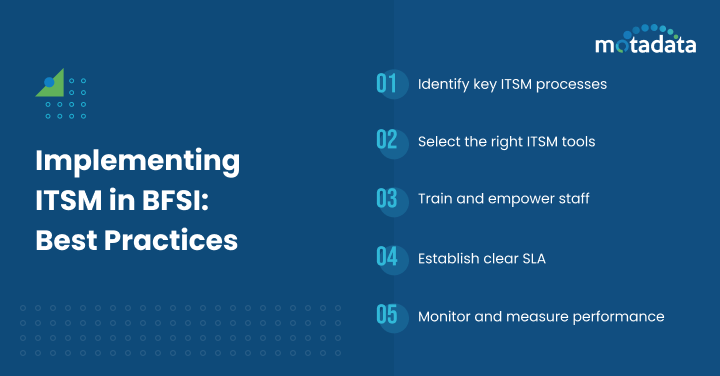

Implementing ITSM in BFSI: Best Practices

If BSFI sector is planning to implement ITSM software to improve customer satisfaction, they must plan first. Careful planning and strategy is essential to overcome the challenges of this sector.

Here, we have listed some of the best practices that financial institutions must adapt for successful ITSM implementation.

Identify key ITSM processes

First and foremost, financial organizations need to understand that various ITSM processes can be used to achieve organizational goals. But, it is also important to understand which ITSM setup will work best for them and bring good results.

Here are a few of the most commonly used ITSM processes for the BFSI sector:

- Incident Management: This process manages your incidents and IT problems. It ensures that IT problems are identified and addressed in real-time to prevent downtime and loss of customer trust.

- Problem Management: This process focuses on identifying and stabilizing the underlying cause of recurring problems in the system.

- Change management: This process handles IT changes carefully to lower risks

- Service Request Management: It allows customers to raise their concerns and submit requests for IT services in a friendly way.

Select the right ITSM tools

It is important to invest in the right ITSM tools based on your financial institution’s size, complexity, and budget.

Here are a few more factors that one must keep in mind when selecting an ITSM solution:

- Scalability: The ITSM tool scales with the financial institution’s growth and expansion. Further, it has the ability to handle more complex IT services.

- Security: Financial data is sensitive and can cause loss to a customer in case of breach or theft. Hence, make sure your tool comes with robust security features and follows industry standards and rules.

- Integration: The tool should integrate nicely with existing IT systems such as CRM, ERP, and SIEM. This is necessary for proper data flow and process automation.

- Automation: Select tools that offer automation functionality. This will help reduce repetitive tasks and allow IT personnel to concentrate on more vital areas.

Train and empower staff

Employees play a key role in ITSM’s success. They must have the right knowledge and skills to implement the selected ITSM processes. So, BFSI organizations must provide adequate training to their IT staff, service desk analysts, and end-users about ITSM core principles and ways to use the tool.

With proper skills, IT team members will be able to help with service delivery and quickly address incidents, resulting in boosting of overall user experience.

Hence, try to run training programs or set a knowledge base for your employees to help staff effectively use ITSM tools and adhere to defined processes. Training should focus on core ITSM principles, best practices, and practical usage of ITSM tools, ensuring that employees can address technical challenges proactively.

In addition to structured training, BFSI organizations should establish a centralized knowledge base that provides step-by-step guidance, troubleshooting tips, and process documentation.

This knowledge base serves as a self-help resource, empowering employees to resolve common issues independently while adhering to ITSM-defined processes.

Establish clear service level agreements (SLAs)

SLAs define expectations for IT service delivery, including response times, resolution timelines, and escalation protocols. Establishing service level agreements, or SLAs, is critical in the banking and financial sector for IT service management.

Clear SLAs contribute to increasing transparency and accountability in service management processes. This links IT operations with business goals. SLAs further assist BFSI in managing problems, service requests, and adjustments. This results in a better client experience in financial services.

Monitor and measure performance

Monitoring your ITSM processes is essential to confirm if you are on the right path to meet your goals. To do this, you must track key performance indicators (KPIs) such as incident resolution time, change success rate, and customer satisfaction score to assess the effectiveness of ITSM implementation and identify areas for improvement.

By regularly checking these performance indicators, financial institutions will gain more clarity into customer needs and business services, resulting in making better decisions.

Further, it will help in resource management, risk management, and boost IT service quality. You must also keep data security in mind and compliance adherence.

Conclusion

The BFSI sector operates in a dynamic and competitive environment where customer satisfaction and operational efficiency are paramount. IT Service Management (ITSM) offers a comprehensive framework to address the unique challenges faced by BFSI institutions, such as downtime, service disruptions, data security, and evolving customer expectations. Further, it allows financial organizations to streamline their IT processes which helps in faster service delivery.

Another advantage of implementing ITSM in the BFSI sector is it helps identify underlying problems in real time and offers more visibility into regular processes. The faster you resolve the issue, the more a customer will be satisfied with your service.

Further, during IT system changes, it helps reduce disruptions and risk. When financial institutions focus on customer service, incident, and problem management, and change control, they may improve their procedures and provide excellent service.

ITSM is a powerful tool that empowers BFSI organizations to deliver exceptional customer experiences However, it is important to choose from the right ITSM tools to ensure long-term success and competitiveness.

As the BFSI sector continues to evolve, adopting ITSM will be key to meeting customer expectations and driving innovation. Just remember to pick the right ITSM software like Motadata and train your employees for smooth operations.

Motadata ITSM is a powerful tool with the ability to streamline business processes, maintain IT and Non-IT assets, reduce security vulnerabilities, etc., that eventually help improve customer experience. Built on ITIL best practices, We provides a unified platform to manage incidents, service requests, problems, and changes, ensuring a structured approach to IT service delivery.

One of the standout features of Motadata ITSM is its user-friendly interface and customizable workflows. With powerful automation capabilities, the platform helps organizations resolve incidents quickly, reducing downtime and improving service availability. You can try out the free version and avail its benefits.

FAQs:

IT Service Management (ITSM) is a framework that manages the delivery of IT services and operations, ensuring they align with business goals to deliver maximum value. It includes processes like incident management, change management, problem management, and improving IT infrastructure.

In the BFSI sector, there are a lot of tasks involved and old practices applied. ITSM implementation automates the workflow and reduces human error. Further, there are fewer service disruptions as issues are identified and addressed faster. ITSM further enhances customer experience by improving response times and ensuring smooth transitions during IT changes.

The success of ITSM implementation can be measured using KPIs such as incident resolution time, system uptime, change success rate, customer satisfaction scores, and SLA compliance.